LOAN CONTRACT

Loan Contract

Pattaya Lawyer

We receive by appointment only

Tel. 0621278812 - 0926921844

or

Line ID : 0621278812 - 0926921844

Email:

[email protected]

The Social Lawyers Co., Ltd.

LOAN CONTRACT

Loan Contract

Pattaya Lawyer

We receive by appointment only

Tel. 0621278812 - 0926921844

or

Line ID : 0621278812 - 0926921844

Email:

[email protected]

The Social Lawyers Co., Ltd.

The Loan Contract In Thailand

From an Article of Dr. Carlo Filippo Ciambrelli

I believe that the majority of us, at a certain point in our lives, have been asked for a mortgage. If not….it could happen one day and you would better be ready and informed!

AN OLD STORY

Let me start with a memory. When I was a boy, I was the only one in our group who did not own a moped. Despite my sincere pleas, no one has ever lent me one, not even for a short run, not even a Velosolex (do you remember it?). Only when my father, unaware of the truth, finally decided that it would be safer to buy a bike instead of being a passenger on my friends' old bikes. That day everything changed. Not only because I had my own bike, but because from then on I could borrow and try all those of my friends!

LOAN AND LOVE

At this point, you can ask me, "But what does this have to do with the law in Thailand?" Carlo went crazy? But if you think about it, you will see that this is the essence of our story today: people do not like to lend their things or money to someone who has nothing. Nevertheless, it seems that such a simple point quickly fades away in Thailand. Love, fatal attractions, pity, dreams, embarrassment, or simply the inability to say "no" could one day put you in the position of being the unfortunate creditor of someone's debt.

What can we do to protect ourselves and recover the money we have imprudently given to someone? Or better: what precautions should we take before giving someone our money?

THE FIRST THING TO DO

is to establish a written loan agreement with the help of an expert.

Never, as in such circumstances, spend a few baht for the assistance of a competent lawyer would save you a lot of money and headache.

The first thing a competent lawyer will suggest is to ask the borrower for a sufficient guarantee.

The law in Thailand provides us with many ways to protect our loan. Let's analyze the

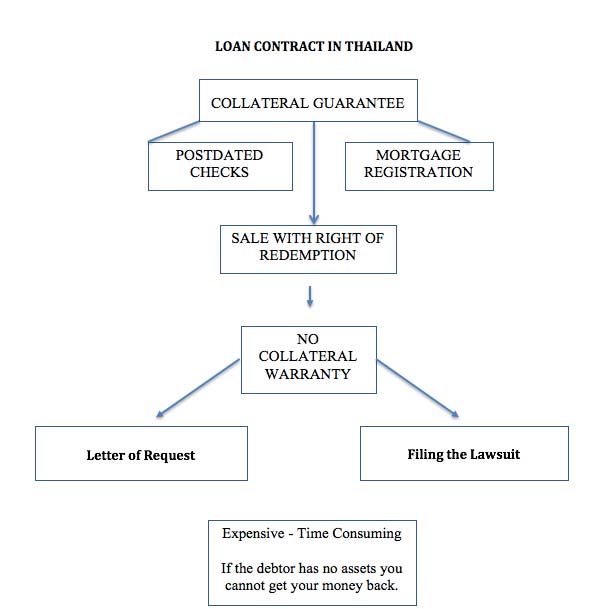

THREE BEST WAYS TO PROTECT YOUR CREDIT:

1) POSTDATED CHECKS

The return of a loan in Thailand can be legally guaranteed with a post-dated check. You can expressly mention in the loan agreement details of the check that would be given as a guarantee. In the event of non-compliance, in other words, if the check turns out to be wood, you will have the right to seize the property of the offender and, most importantly, the offender will face criminal charges... The offender will risk the prison! And if he is a stranger, the blacklist.

2) MORTGAGE REGISTRATION

While it is true that foreign nationals can not buy land in Thailand in their name, they can legitimately register a mortgage on any real estate property belonging to a Thai person or a Thai company. The cost of registering a mortgage is moderate, and it will entitle the lender to oblige the mortgagor to sell it by public auction in case of default.

3) SALE WITH RIGHT OF REDEMPTION

Even if it is not really orthodox and unusual among foreigners, it is the most popular (and safest) way to secure debt in Thailand. In other words, the person who obtains a loan can sell his property with the right to redeem it at a price agreed with the buyer. In the event of default, if the borrower (seller) does not pay the lender (buyer), the lander would automatically become the new owner of the property, without the need for further legal action.

NO COLLATERAL WARRANTY

If you decide to generously grant a loan to a person without legal and appropriate guarantee, even if you establish a written and perfect contract, possibly signed by the blood of the debtor (!), be advised: you will normally have very little chances to recover your money, especially if the borrower has no assets registered in his own name.

COURT FEES

Furthermore remember that in an attempt to recover your money, you will be required to file a lawsuit in the civil court, pay a lawyer and a mandatory 2% court fee.

The Social Lawyers Co., Ltd. 306/2 moo 12, Tappraya Road, Nongprue, Banglamung, Chonburi 20150 (in the Thabali Complex) Thailand [email protected]